Download the White Paper

White Paper: Digital Banking & QA Testing Challenges it Presents

What is at stake for retail banks?

To succeed in 2020 and beyond, retail banks must provide a digital customer experience that is personalized, accessible, and secure while also overcoming the challenges of testing banking applications, websites, and more.

Competition within the retail banking industry continues to grow thanks to the rise of new actors like neobanks that offer a fully digital banking experience. Simultaneously, consumer needs and expectations are evolving as young, tech-savvy Millenial and Generation Z consumers make up a greater proportion of the retail banking market.

Today, the creation and implementation of a digital transformation plan is one way retail banks are striving to adjust to greater competition and evolving market conditions.

These efforts by retail banks go beyond the desire to give customers the power to carry out basic bank transactions via banking apps or websites. Instead, it involves the development of digital platforms that enables customers to fully manage their finances as well as take advantage of personalized services and products.

Nonetheless, these efforts present new, significant challenges for the development teams. One such challenge is testing banking applications and websites as well as chatbots and other digital platforms used to serve customers.

QA testing, whether executed as an automated regression test or a manual user acceptance test, allows banks to uncover bugs or anomalies that can compromise the performance, stability, security, and overall effectiveness of their digital banking platforms.

Having the right experiences, resources, and overall insight is vital for planning and executing the right test campaign.

In this white paper, you will discover:

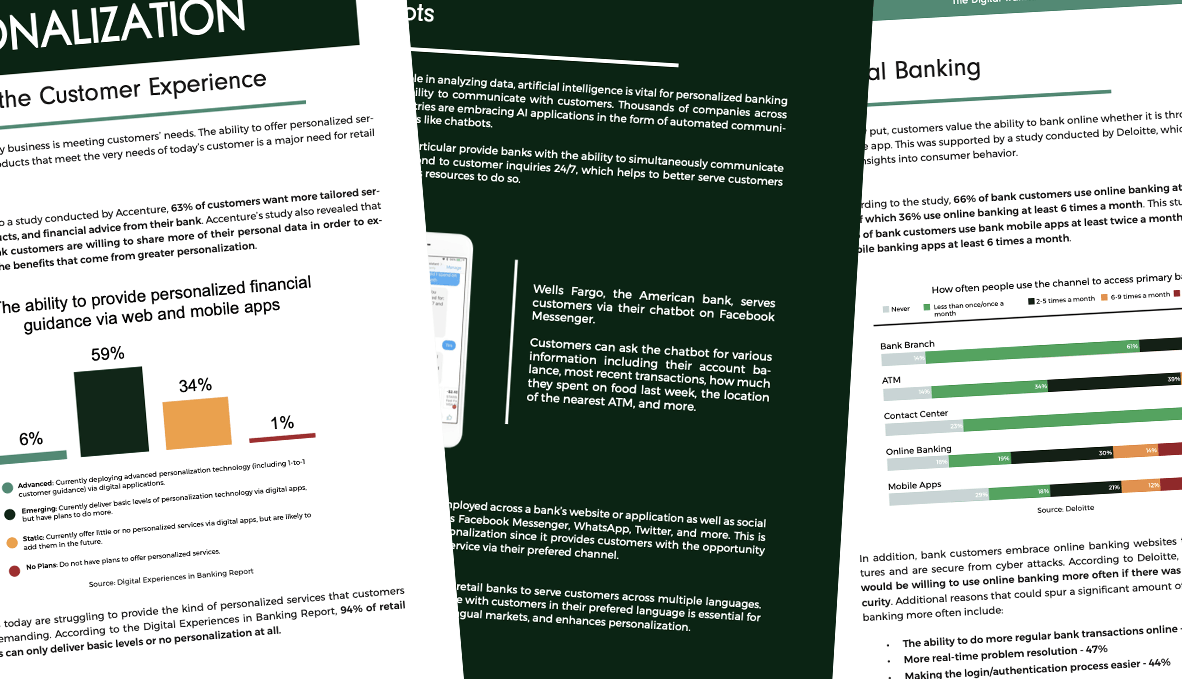

- How banks are using technology to provide more personalized services and products

- How technology is making banking more accessible

- Challenges that banks must overcome to provide a great digital customer experience

- A client case study highlighting StarDust’s experience in the retail banking sector

- And much more…